Building your dream home is exciting, but it’s also a big investment.

Before signing a building contract, it’s essential to ensure your Builder has the proper insurances in place. The right coverage protects you, your property, and your peace of mind throughout the construction process and beyond.

Over the years, we’ve heard from several friends and clients who shared their experiences of projects going wrong with other Builders, the stories that highlight just how important it is to check these protections upfront. Without adequate protection, even a small mishap could derail a project.

Here’s what every homeowner in Newcastle should check before starting their build.

1. HBCF Insurance (Home Building Compensation Fund)

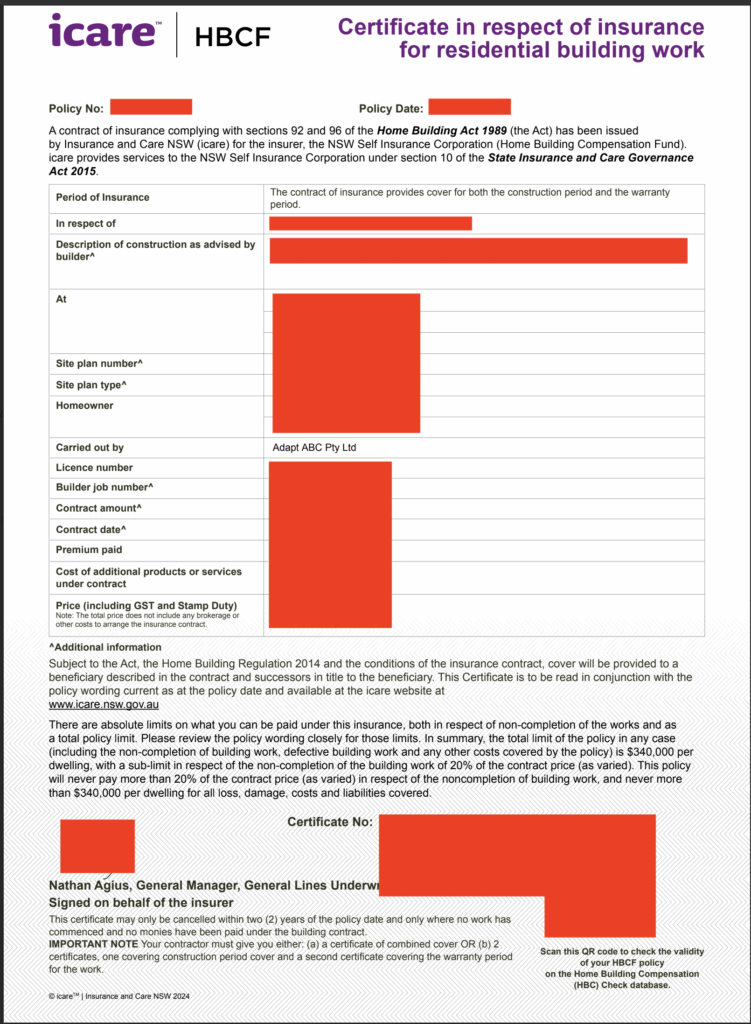

In NSW, it’s mandatory for most residential projects over 20k. The Builders will need to confirm they are eligible for HBCF prior to taking out this cover which is offered by a single insurer operated by the NSW government, Icare HBCF. Then they will be able to begin obtaining warranty certificates of insurance for individual building projects prior to undertaking any work.

Before you sign a contract, ask your Builder to provide a current certificate of insurance, and make sure it’s valid for your project.

HBCF insurance protects you and ensures your project can be completed if something goes wrong, such as the Builder going bankrupt.

Adapt’s HBCF Example

Check more resources here: https://www.service.nsw.gov.au/nswgovdirectory/home-building-compensation-fund-hbcf

2. Public Liability Insurance

Construction sites have risks, and accidents can happen. Public Liability Insurance covers injuries or property damage caused by your builder or their team while on your property. This insurance ensures that you won’t be left financially liable if something unexpected occurs during construction.

3. Contract Works Insurance

Contract works insurance protects your home while it’s being built, including materials and structures on site. It covers risks like fire, storm damage, or theft. Having this insurance in place means your investment is protected from unforeseen events during the build.

4. Workers’ Compensation Insurance

If a worker is injured on your site, Workers’ Compensation Insurance covers medical costs and lost wages. This protects both your Builder’s employees and you as a homeowner from potential financial liability.

Many homeowners overlook this step, but confirming your Builder’s insurance can save you from costly problems later. Builders cannot enforce the contract, commence work, or receive any money (including the deposit) from the client – if they have not provided the required insurance certificates. It’s not just a legal requirement, it’s about keeping your dream home on track and protecting your investment. If you’re unsure about any of these documents, do your research or ask for professional advice. We hope this article helps.

At Adapt Building, we take insurance seriously. All our projects are backed by HBCF, Public Liability, Contract Works, and Workers’ Compensation Insurance, so our clients can focus on the excitement of building their home, not the risks.